©2025 Branagans Accountancy Services Ltd

Our Blog

March 2025 | Upcoming Changes to Voluntary National Insurance Contributions

From 6th April 2025, the timeframe for making voluntary National Insurance (NI) contributions will be significantly reduced. Currently, individuals can make contributions to fill gaps in their NI record dating back to 2006. However, from this date onwards, voluntary contributions will only be permitted for the previous six tax years (currently 2019/20 to 2024/25). This adjustment may have a substantial impact on state pension entitlements. Individuals with gaps in their NI record prior to 2019/20 will no longer have the option to rectify these shortfalls after 5th April 2025.

NATIONAL INSURANCE CONTRIBUTION REQUIREMENTS FOR FULL STATE PENSION

To qualify for the full state pension, individuals typically require 35 years of qualifying National Insurance contributions. Those with an incomplete contribution record may receive a reduced pension. It is therefore advisable to review NI records as soon as possible to determine whether any voluntary contributions are necessary.

IMPLICATIONS OF THE APRIL 2025 DEADLINE

After 5th April 2025, voluntary contributions can only be made for the last six tax years (2019/20 to 2024/25). Individuals with outstanding contributions before 2019 must make the necessary payments before this deadline or risk losing the opportunity to enhance their pension entitlement.

HOW TO REVIEW YOUR NATIONAL INSURANCE RECORD

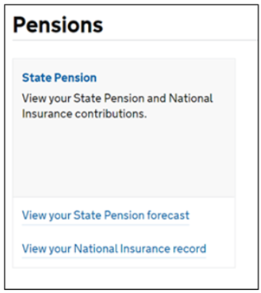

To check your NI record and assess any potential gaps:

1. Access your Personal Tax Account via the Government Gateway -

2. Review your NI contributions -

3. Assess your state pension forecast -

HOW WE CAN HELP

At Branagans Accountancy Services, we provide expert guidance on personal tax matters, including National Insurance contributions and state pension planning. Should you require assistance in assessing your NI record or making voluntary contributions, please do not hesitate to contact us on 01709 327 215 or email info@branagans.co.uk.

Use our click to call number to get in touch: